Don’t miss these often overlooked tax deductions and credits when you file your tax return this year.

When you purchase through links on our site, we may earn an affiliate commission. Here’s how it works.

The 2024 tax season is underway, and unless you are granted a tax extension by the IRS, 2023 federal income tax returns are due on April 15 this year. Don’t miss out on these most overlooked tax deductions and credits when you file. If you qualify, claiming the deductions and credits on this list could lower your tax bill or — in some cases — result in a tax refund.

Some of the tax deductions below require you to itemize deductions. While most people take the standard deduction, itemizing can result in a higher deduction for some. To determine which option is best for you, calculate all your allowable itemized deductions. If the total is higher than the standard deduction for your filing status for the 2023 tax year, itemizing deductions might be a good option.

If you itemize deductions, don’t forget about all the charitable contributions you made throughout the year. These can include cash, property (for example, art and home furnishings), and even out-of-pocket expenses incurred for volunteer work. If you had to drive for your volunteer work, you can deduct expenses one of two ways.

Just remember to keep receipts from charitable organizations and good records of your contributions and your mileage (or fuel) costs, and keep in mind that not every donation is considered tax-deductible. To deduct a contribution on your tax return, the charity must be an approved tax-exempt organization. You can use a search tool on the IRS website to see which organizations qualify.

Additionally, the IRS imposes additional requirements when donating gifts worth $250 or more. IRS Publication 1771 details requirements for making tax-deductible charitable contributions.

No one likes paying student loan interest, but doing so might save you money at tax time. That’s because you can deduct up to $2,500 (or the actual amount, whichever is less) of the interest paid on qualified student loans in 2023. The interest paid can be on any qualified student loan that you took out for yourself, a spouse, or someone who was dependent at the time you took out the loan. And the best part is you can take the student loan interest deduction, even if you don’t itemize deductions when you file.

However, not everyone who paid student loan interest is eligible to deduct student loan interest payments on their 2023 federal tax return.

Can you deduct student loan interest paid by a parent? Taxpayers can also deduct student loan interest if a parent pays their student loans as long as they can no longer be claimed as a dependent.

If you paid more than $600 in qualified student loan interest in 2023, you should have received a Form 1098-E.

Contributions to traditional IRAs and 401(k)s aren’t taxed, but some people who contribute to these (and select other) retirement accounts qualify for even bigger tax breaks. Better known as the Saver’s Credit, the retirement savings contribution tax credit allows eligible filers to claim a tax credit worth up to $2,000 ($1,000) for single filers.

The amount of the credit depends on your contribution amount, your filing status, and your adjusted gross income (AGI). If your 2023 AGI exceeds the income thresholds below, you aren’t eligible to claim the Saver’s Credit.

Gambling winnings, which include lottery winnings from Mega Millions and Powerball, are considered taxable income. However, winners can reduce their tax liability by deducting gambling losses. Lottery losses aren’t the only types of losses that qualify.

However, there are a few catches. Taxpayers can only deduct gambling losses if they itemize, and you can’t deduct losses that exceed your winnings.

Some taxpayers can receive tax credits for dependents, regardless of age. For example, while the 2023 child tax credit only applies to qualifying dependents under age 17, older children and even adults could be considered qualified dependents for the purpose of claiming the tax credit for other dependents.

The credit is worth up to $500 for each qualifying dependent. However, the same dependent cannot qualify for both the child tax credit and the credit for other dependents. The IRS has a tool taxpayers can use to determine whether or not their dependent qualifies for the tax credit for other dependents.

Some employers require employees to surrender jury pay. This can sometimes occur when an employee continues to receive their regular salary while serving jury duty. Jury pay is considered taxable income by the IRS, but any amount surrendered to an employer is tax-deductible.

Taxpayers can deduct surrendered jury pay whether or not they take the standard deduction, but no deduction is allowed for jury pay that the employee keeps.

While several taxpayers know the child and dependent care credit exists, some might miss out because they don’t think their child care expenses qualify. You can use more than traditional daycare expenses to calculate the credit.

Taxpayers can receive a nonrefundable credit of between 20% and 35% of up to $3,000 ($6,000 for two qualifying dependents) of qualifying childcare expenses. To qualify for the child and dependent care credit, the expenses must have been incurred so you (and your spouse if filing jointly) could work or look for work.

Additionally, dependents over age 13 are not considered qualified dependents for the purpose of claiming the credit. However, care expenses for a dependent with a disability may qualify, regardless of age.

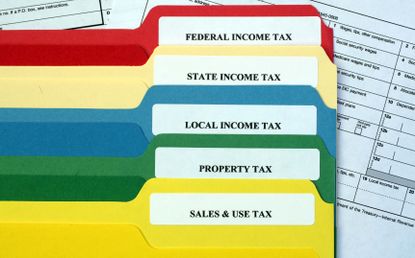

The state and local tax (SALT) deduction allows taxpayers to deduct state and local taxes paid to certain governments. This deduction is only available to those who itemize rather than take the standard deduction. For 2023, taxpayers can write off up to $10,000 ($5,000 if married and filing separately) of eligible taxes paid, which may include the following:

It’s important to note that there are some exceptions to deducting the types of taxes listed above. A qualified tax professional can help you determine what taxes you paid in 2023 are deductible.

You may know that you can deduct mortgage interest, but mortgage points, sometimes referred to as loan origination fees, maximum loan charges, loan discount, or discount points), are also tax-deductible for those who itemize deductions.

If more than $600 of mortgage interest was paid in 2023, homeowners will receive a Form 1098 from their lender, which will also include mortgage points paid. However, interest and mortgage point amounts reported on the form might differ from the amounts you can deduct this year.

The IRS has specific rules for who can claim mortgage points in the year they were paid and who can’t. In addition to other requirements, taxpayers must deduct points over the life of the loan if either of the following applies:

Homeowners can use a tool on the IRS website to determine whether their mortgage points are fully deductible for the 2023 tax year.

Moving expenses are only tax-deductible for Armed Forces members. Additionally, only expenses incurred for moves due to a military order and for a “permanent change of station” are deductible. However, if any of the following apply, the spouse of an Armed Forces member may also qualify to deduct moving expenses.

Unreimbursed relocation costs incurred for returning home from a post of active duty qualify as tax-deductible for service members and their spouses. For more information, see IRS instructions for Form 3903.

Related Content